Advertisement

Donald Trump’s Tax Plan Would Mostly Benefit Wealthy, Expand Deficit $10.8T

UPDATE: The conservative-leaning Tax Foundation did their own analysis of Trump’s tax plan and they estimate his plan would cost nearly $12T over 10 years, about $1T more than Citizens for Tax Justice. So, either way, it’s not good. Original story continues below.

On Monday, Republican presidential candidate Donald Trump released his tax plan proposal after weeks of campaigning that he would be raising taxes on the very wealthiest Americans and hedge fund managers. His plan, though not fully articulated, has already drawn criticism from economists that it would expand our deficit and mostly benefit the wealthy.

In announcing the plan, Trump said, “It will provide major tax relief for middle income and most other Americans.”

The plan would reduce the current seven tax brackets down to four. Trump has proposed eliminating some deductions for the wealthy and closing loopholes, but his plan released Monday did not offer many specifics.

While his rhetoric has taken a very populist approach to the issue of taxes, many agree his plan would most benefit those in Trump’s top income bracket.

“It’s hard to imagine a way it would not benefit the rich,” said Robertson Williams, senior fellow at the Tax Policy Center.

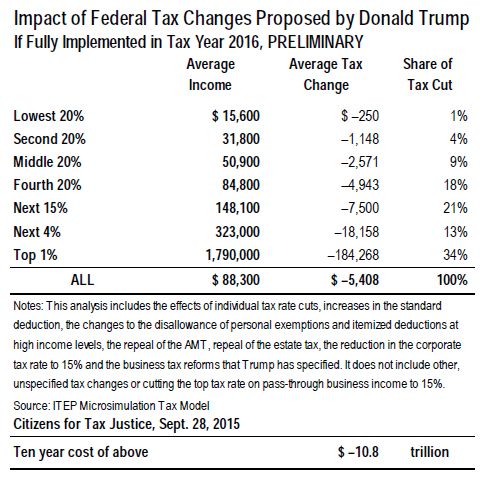

Citizens For Tax Justice, who also scored Jeb Bush’s tax plan, estimated over one-third of the overall tax benefit would go to the Top 1%.

According to CNN Money, for the wealthy, “Under Trump’s plan, singles earning more than $150,000 and couples earning more than $300,000 would pay only 25% on their income above those thresholds. But they would also benefit from the lowering of the other tax rates to 0%, 10% and 20%.”

Trump would also eliminate the estate tax, which only affects the very wealthy. He would eliminate the Alternative Minimum Tax and the marriage penalty, two more huge windfalls for the upper class.

Trump says “there will be people in the very upper echelon that won’t be thrilled” with the tax plan.

He’s alluding to the elimination of deductions and loopholes available to the very rich, but he did not offer specifics, so it’s impossible to tell how big a hit the wealthy would actually take overall with their savings in other areas, CNN Money said. But based on the number from Citizens for Tax Justice, their total would fall nearly $200,000 per year.

The middle and lower classes would see a drop in their tax rates, but according to the chart, the bottom 60% of Americans see a total of only 14% of the tax savings.

Of course, the eye-popping figure of a total cost of $10.8 trillion over 10 years should alarm anybody even mildly concerned with the overall federal debt. To make up a trillion dollars per year in added revenue would be a difficult under a perfectly thriving economy, which Trump seems to believe will happen simply because he’s president.

“It will grow the American economy at a level that hasn’t been seen for decades.”

Somebody should maybe tell Trump that over the last few decades, the economy was strongest when taxes were raised.

Well, at least Trump still has this lady supporting him.